A closer look at the UK's free trade agreement with Japan

A UK-Japan Comprehensive Economic Partnership Agreement had been agreed in principle by the two parties, so what does it include?- New protection for more iconic UK goods – increasing geographical indications (GIs) from just seven under the terms of the EU-Japan deal to potentially over 70 under our new agreement, covering goods including English sparkling wine, Yorkshire Wensleydale and Welsh lamb.

- More generous market access for malt producers – Japan has guaranteed market access for UK malt exports under an existing quota which is more generous and easier to access than the EU quota. The UK is the second biggest exporter of malt to Japan, with UK producers exporting £37m there each year.

- Strong tariff reductions for UK pork and beef exports – We have negotiated a deal that sees tariffs fall on pork, beef, salmon and a range of other agricultural exports. We will continue to benefit from access to the low tariffs for key food and drink products covered by quotas, such as Stilton cheese, tea extracts and bread mixes.

What does the existing trade deal currently offer?

The UK currently has access to the EU-Japan FTA which entered into force in January 2019. While there may be differences between the new agreement and the EU deal, the timescales in which this deal have been negotiated make it likely that the UK-Japan deal will have a number of similarities to the EU counterpart, as well as the fact the UK government stated that the deal would be using the EU-deal as a base.

The EU negotiated a number of concessions within their trade deal that could benefit UK businesses

- Reduction and simplification of tariffs on pork and processed pork products

- Reduced tariffs on cheeses - from 29.8 percent to 0 percent over 15 years for hard cheeses and duty free quota on soft cheeses

- Reduction of beef tariffs from 38.5 percent to 9 percent over 15 years

- Increased EU quotas for malt, potato starch, skimmed milk powder, butter and whey

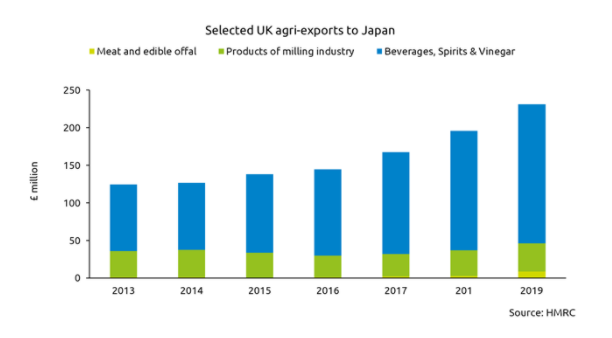

Current UK-Japan trade

The UK was recently granted access to the Japanese market for beef and lamb after a decade long ban. In 2019, Japan imported around 705,000 tonnes of beef, including offal. Imports have been steadily growing year on year. Major suppliers Australia and The US dominate the beef market, suppling high-quality grain and grass fed beef. The UK currently has access to a tariff rate quota as part of the EU deal which is open to all European Member States. This is equivalent to tariff rates that the US and Australia have access to through their respective agreements, although both countries have access to much larger quotas. In the first half of 2020, the UK shipped around £6.6 million worth of total beef (incl. offal) to Japan, up from just over £715,000 in the first half of 2019.

Malting exports to Japan are a key market for the UK. Under the EU deal the UK has access to an 187,500t tariff free quota. Malt exports fluctuate from year to year depending on availability. Japan imports around 500,000t of malt per year and the UK is already a major supplier. UK exports of malt to Japan averaged around 75,000t in the last three years*.

*Crop marketing years

Whisky is also a major export for the UK, with exports of spirits growing significantly year on year. UK producers will be hoping to capitalise on increased malt demand, both from Japanese based distillers producing their own whisky as well as increased demand for UK produced whisky.

AHDB work in the Japanese market

For a number years, the Japanese market has been high on the priority list for the AHDB exports team, originally supporting pork exporters develop a market in Japan through a targeted trade development programme. Developing market access is a key strategic area for AHDB, working in partnership with government, providing in-depth technical support. In early 2019, the Japanese market opened for British beef and lamb imports, this enhanced access enabled the export team to increase its focus on developing the market, and Japan is now one of four key markets, outside of the EU, that AHDB export focuses on.

In 2016, AHDB led the first commercial mission of UK pork exporters to Japan, which was followed by a successful beef and lamb exporter mission to market as the market opened up in 2019 around Japan’s leading food related trade fair, Foodex. Both missions, included market insight visits, including the supply chain, retail and foodservice scene together with the all -important business to business meetings with key food importers and distributors, AHDB work closely with the British Embassy in Tokyo to utilise their team’s expert local knowledge of the market.

Having broader access has now required additional in-market support to deliver a programme of events in Japan to support the sector achieve ambitious export targets. A specialist, Tokyo based, agency was appointed earlier this year. With current travel restrictions, this has been timely, and is now key in delivering activity on the ground in market. Our dedicated agency is focused on raising the profile of UK meat and dairy products through a programme of activity highlighting to importers and distributors of both the retail and foodservice sectors and ultimately consumers what the UK has to offer in terms of quality, safe and sustainable production. Working with local chefs, for example, is crucial on creating ambassadors for our produce and supporting work in creating dishes that appeal to local consumers using the great produce the UK has to offer.

Going forward, AHDB will be carrying out more detailed analysis into the impacts arising from the UK-Japan trade agreement. This will include looking at how the EU have benefitted from a trade deal with Japan, who the key suppliers are both within the EU and outside of it, as well as where potential opportunities for growth in the Japanese market are.