Turkey is the Price-Savvy Protein for Thanksgiving

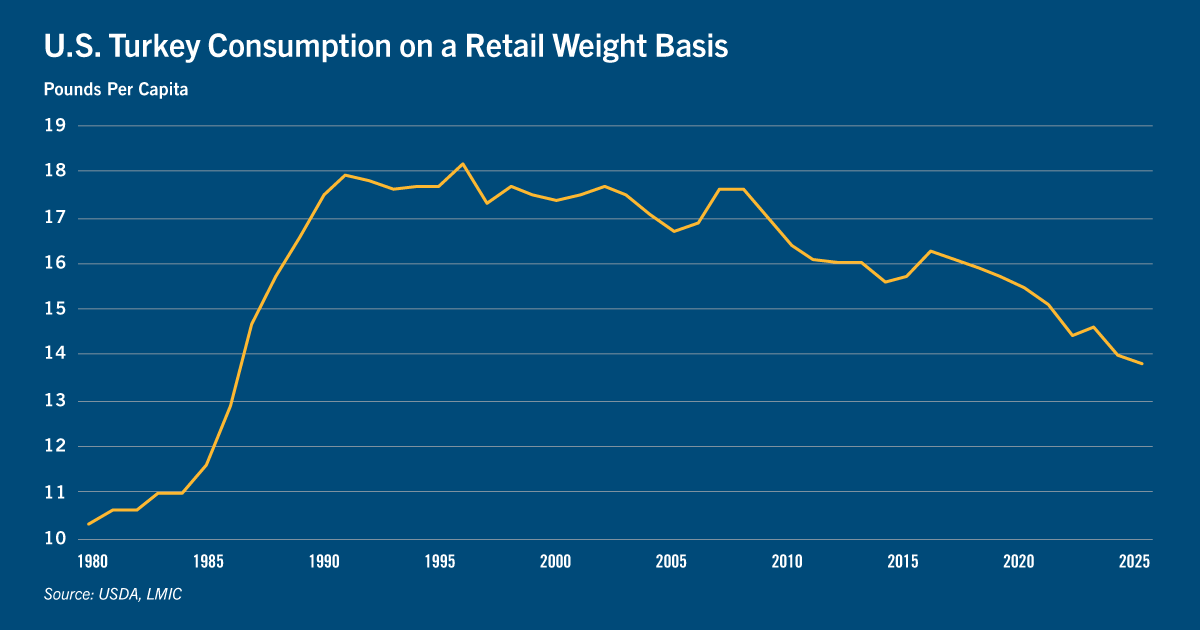

Turkey at Thanksgiving may be a traditional sight, but whole retail turkey consumption between October and December 2023 was the lowest since 1980Thanksgiving is the second-largest U.S. food holiday, driving an estimated $2.1 billion in sales lift at grocery stores.¹ And a turkey on the table for Thanksgiving is a familiar sight for many American families, a time-honored tradition long embedded in American culture. Whether through supply-related issues, consumer desire for convenience, or changing preferences, the future of this tradition and the US consumer support to the turkey industry has become less certain in recent years.

Other animal proteins are rallying to be the holiday meal centerpiece

Most consumers think about cooking a whole turkey only once a year. And even then, attention is in decline. Whole retail turkey consumption between October and December 2023 was the lowest since 1980, at just 4.04 lbs. per capita. Other animal protein segments, like beef and pork, are taking note of shifting consumer purchasing behavior. They want in on the Thanksgiving action, and consumers are interested.

Promotional activity around the holidays drives much of what shoppers put in the cart. Thanksgiving comes with a widely utilized retail tactic called “loss-leader” to drive foot traffic. Retailers will typically price a turkey low, at a loss, or sometimes free, in hopes that sales on the remainder of the consumer’s Thanksgiving meal shopping cart will include items that help offset those losses.

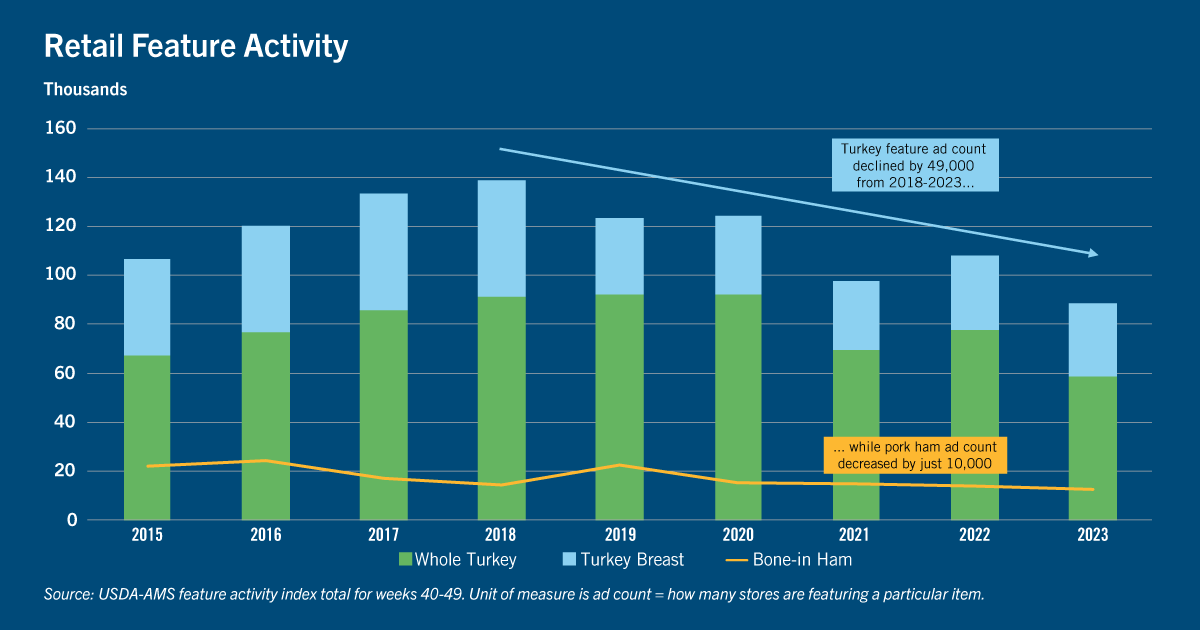

While turkeys still prominently appear on the front page of retail advertisement in weeks leading up to Thanksgiving, over the past few years USDA’s feature activity index for weeks 40-49 has shown a noteworthy decline. Frozen turkey features in these key weeks were down 36% in 2023 from 2018 levels. However, while not to the same degree, ham features were down 14% over the same period. This could partially explain falling disappearance rates at the key time frame of the year.

However, the data does not include “no-price” features such as buy one item get one half off or spend a certain dollar amount and receive one center of plate item free (such as a turkey, turkey breast, ham or other). Also, prepared entrees have become commonplace at Thanksgiving, and that is also not covered in this data. Thus, we rely more broadly on production and inventory levels to analyze whole turkey demand.

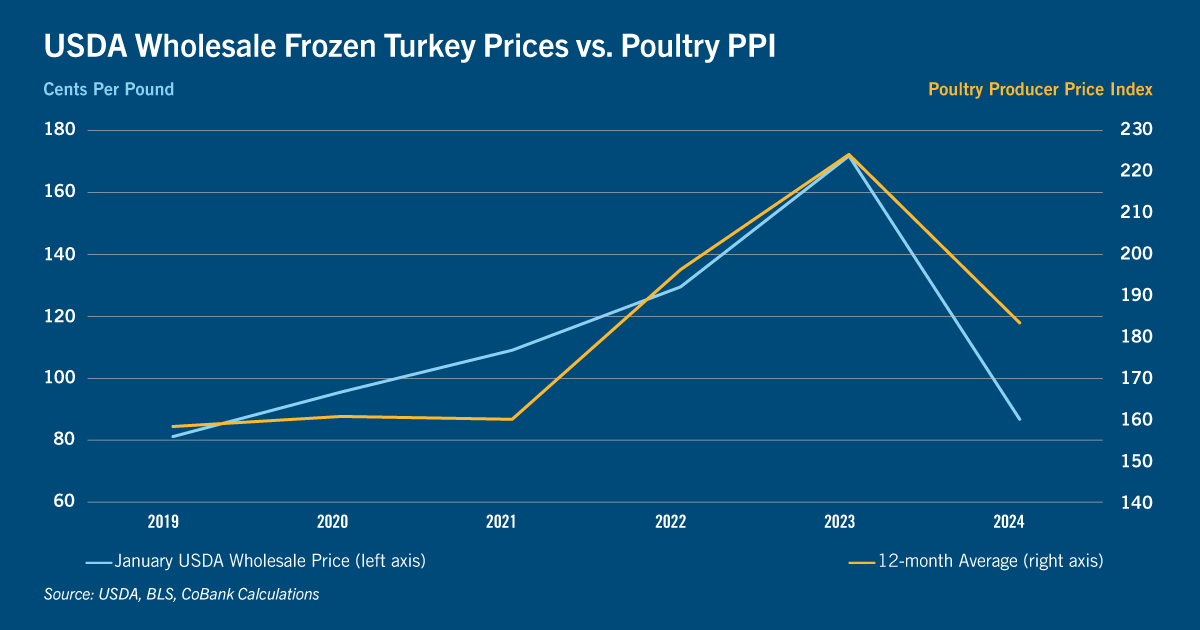

Turkey prices should be more favorable for consumers this Thanksgiving

To get an idea of what prices consumers should expect at the grocery store this Thanksgiving, it is important to understand that the turkey industry prepares all year for the holiday. The majority of contracting for Thanksgiving turkeys typically occurs in the first quarter of the year. For example, during January 2023, wholesale prices for frozen whole turkey hens reached a record of $1.71/lb., up 33% YoY and 112% higher than in 2019 (pre-pandemic). And somehow retailers in the most competitive markets were still able to offer whole frozen turkeys to consumers for less than $0.30/lb. For 2024, wholesale prices were down 50% YoY, at an average of $0.87/lb., the lowest since 2019.

Inflation has taken its toll on both producers and consumers in recent years. Although feed corn prices have been easing from their most recent peaks over the last 12 months, turkey producer costs have remained elevated since 2023, and were down just 18% YoY for the 12 months ended in January 2024. This all suggests that wholesale values adjusted down more ferociously than producer costs as producers prepared turkey supplies for the 2024 holiday season.

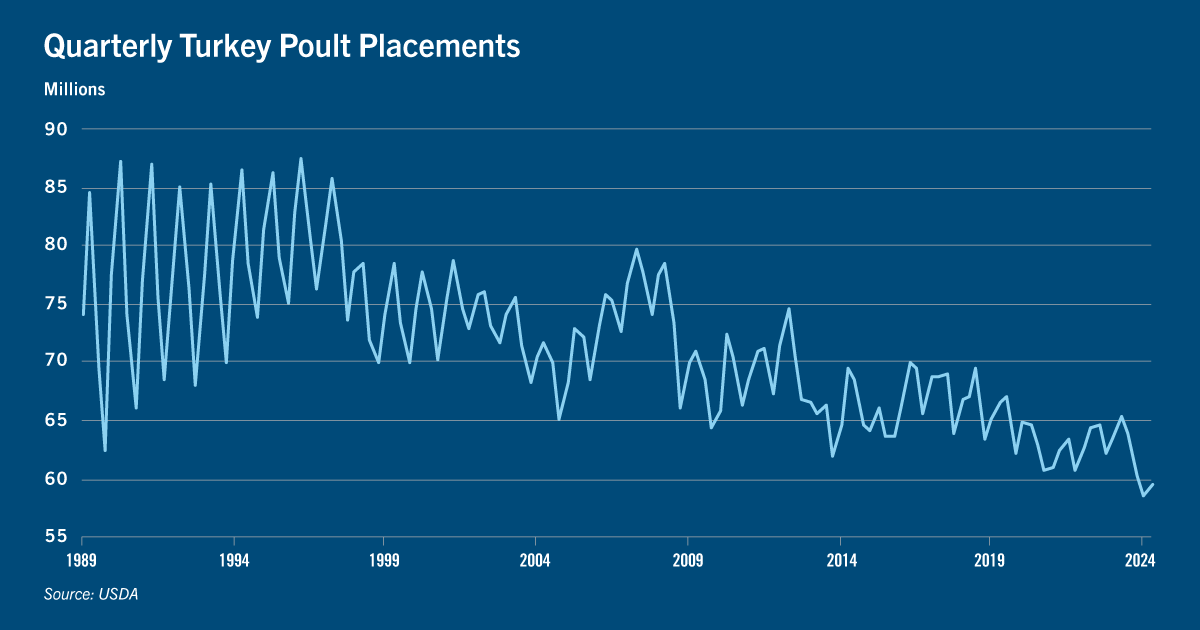

Turkey supply in decline, but the shift may not be all that noticeable in 2024

As retailers began preparing for Thanksgiving features this past January, projections for turkey inventories were reported at their lowest point in four decades, signaling reduced availability for Thanksgiving in 2024. Outside of consumer preference, the animal protein industry has faced supply-limiting challenges: high operating costs, labor shortages, regulatory hurdles and disease-related issues. U.S. turkey flocks have struggled with two diseases in particular: Highly Pathogenic Avian Influenza (HPAI) and avian metapneumovirus (AMPV).

The U.S. turkey industry was impacted heavily by depopulations in commercial houses, including breeder facilities during the fourth quarter of 2023. Both viruses causing HPAI and AMPV have contributed to these heavy declines. However, the primary reason for fewer turkey poult placements has been weak profitability for U.S. turkey growers.

A multitude of production costs rose rapidly through 2020 and beyond. While some costs like feed (the biggest expense in turkey production) have been in decline over the last 18 months, costs of labor, capital, packaging, energy, interest rates and other factors have all kept the poultry producer price index from falling back to pre-pandemic levels. However, at less than $0.90/lb., wholesale values for whole frozen turkeys were reported at some of the lowest levels in modern times, negatively impacting producer margins for 2024.

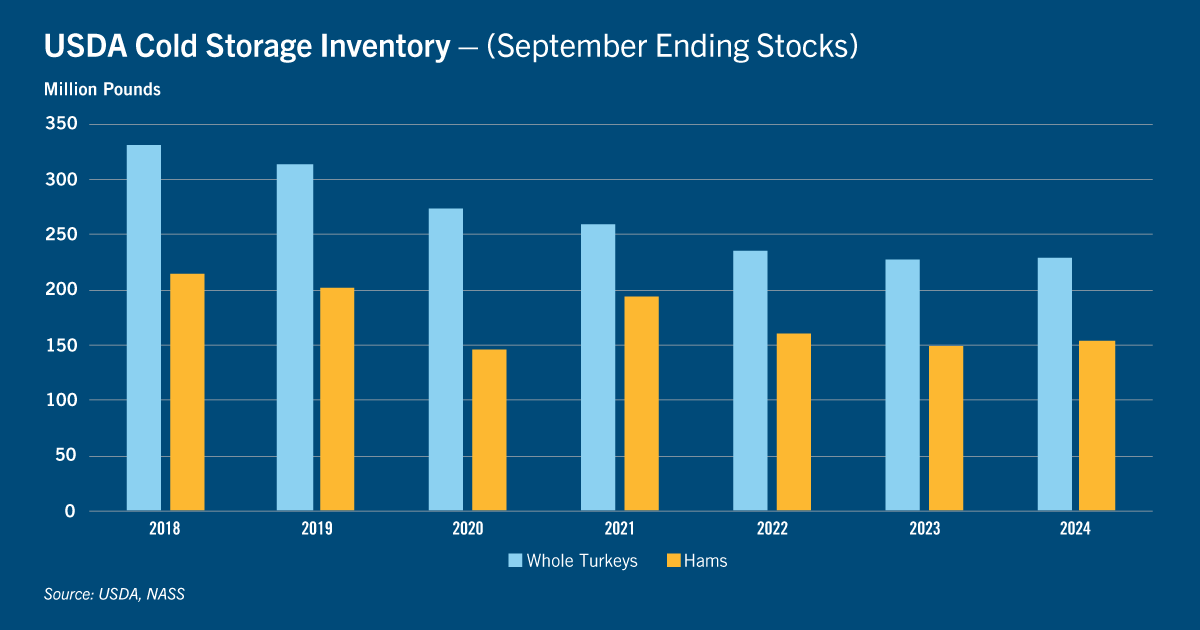

While the starkly lower placement numbers would suggest a sizeable decline in turkey availability for Thanksgiving, inventories of whole turkeys in cold storage were up about 4% YoY, when they peaked in September this year, at 246 million pounds. But that contrasts with roughly a 100-million-pound decline when compared with 2018, suggesting the market is more accepting of smaller supplies of whole birds. Similarly, inventories of hams in cold storage were in line YoY, but down just 61 million pounds vs. 2018 peak.

Turkey industry will suffer as consumer demand shifts during Thanksgiving

So how will the market deal with a 160 million-pound-decline in combined frozen whole turkey and ham availability from its peak in 2018? Traditions are changing; this might be the “new norm” as consumption is trending downward for traditional center-of-plate offerings. Marketers are being challenged to creatively market turkey meat and thrive through innovation. If consumers are becoming comfortable with declining availability of whole turkeys around the holidays, producers should consider more closely evaluating the overall product mix.

While whole turkey demand might be slipping, the opportunity to grow consumption may be elsewhere. Grinds have shown tremendous strength this year. Ground turkey retail volume sales are up 5.5% YoY and are at $1.9 billion through the 52 weeks ending Sept. 8.² Ground turkey is the second-largest ground category, only behind ground beef. This strongly suggests that while the traditional imagery of turkey may be Norman Rockwell’s iconic “freedom from want” painting, the U.S. consumer perception of turkey is changing.