Weekly global protein digest: Colombia fully reopens to US beef after lifting H5N1 ban

Livestock analyst Jim Wyckoff reports on global protein newsWeekly USDA US beef, pork export sales

Beef: Net sales of 10,100 MT for 2024 were down 35 percent from the previous week and 34 percent from the prior 4-week average. Increases were primarily for China (2,100 MT, including decreases of 100 MT), Japan (1,700 MT, including decreases of 200 MT), Mexico (1,600 MT), South Korea (1,400 MT, including decreases of 300 MT), and Canada (1,200 MT). Total net sales of 100 MT for 2025 were for Japan. Exports of 12,500 MT were down 24 percent from the previous week and 14 percent from the prior 4-week average. The destinations were primarily to South Korea (3,100 MT), Japan (2,600 MT), China (1,500 MT), Mexico (1,300 MT), and Taiwan (1,100 MT).

Pork: Net sales of 28,000 MT for 2024 were down 3 percent from the previous week and 8 percent from the prior 4-week average. Increases were primarily for Mexico (13,000 MT, including decreases of 300 MT), Canada (3,300 MT, including decreases of 700 MT), China (2,700 MT), South Korea (2,500 MT, including decreases of 500 MT), and Colombia (1,900 MT, including decreases of 100 MT). Exports of 27,900 MT were down 11 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Mexico (11,800 MT), Japan (3,600 MT), China (3,000 MT), South Korea (2,000 MT), and Colombia (1,900 MT).

China to stabilize beef, dairy sectors to aid farmers

China’s agriculture ministry said it would stabilize beef and dairy production, shore up consumption and assist farmers amid falling prices. The ministry’s plan called for the promotion of beef and milk consumption and support for farmers by offering loan extensions and lowering feed costs. The plan said localities would be required to accelerate the expansion of herds, while promoting higher quality cows. Vouchers will be used to push more milk consumption. The ministry called for prevention and control of disease in cow herds and said more targeted support policies would eventually be rolled out for agriculture and other sectors. China’s beef prices have fallen to the lowest level in five years.

USDA Hogs & Pigs report expected to show marginally larger US hog herd

Analysts expect USDA’s Hogs & Pigs Report this afternoon to show the U.S. hog herd grew 0.2% from year-ago to 76.285 million head as of Sept. 1. Market hog inventories are expected to be up 0.4%, while the breeding herd is anticipated to be down 2.1%. Analysts expect USDA to report a 0.9% smaller summer pig crop despite ongoing record litter sizes, as summer farrowings likely declined 1.4%. Looking forward, analysts expect farmers to farrow 0.4% fewer sows during fall but 0.1% more this winter. As always, revisions to past data will be key.

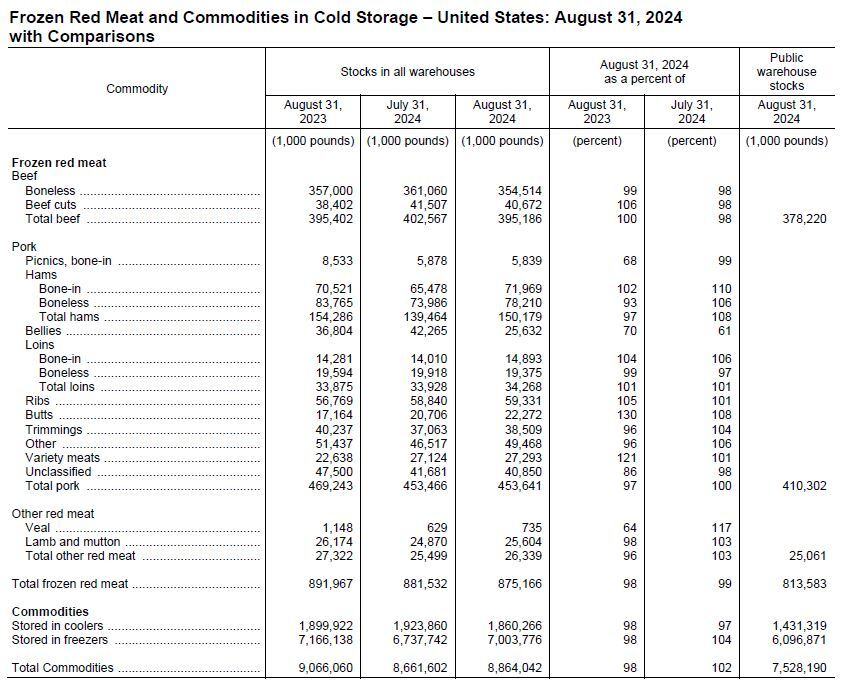

USDA Cold Storage Report shows pork and beef down from year-ago

Total red meat supplies in freezers were down 1 percent from the previous month and down 2 percent from last year.

Total pounds of beef in freezers were down 2 percent from the previous month and down slightly from last year.

Frozen pork supplies were up slightly from the previous month but down 3 percent from last year. Stocks of pork bellies were down 39 percent from last month and down 30 percent from last year.

The five-year average is a 5.1-million-lb. increase in beef stocks and a 5.3-million-lb. rise in pork stocks during the month.

Colombia fully reopens to US beef after lifting H5N1 ban

USDA’s Food Safety and Inspection Service (FSIS) said U.S. beef and beef products were no longer ineligible for export to Colombia as of Sept. 23. The U.S. Meat Export Federation (USMEF) confirmed that Colombia has lifted its ban on U.S. beef from states affected by H5N1 in dairy cows, restoring access to beef from 13 states. USMEF President Dan Halstrom expressed gratitude to USDA teams and Colombian importers, emphasizing the significant impact the ban had on trade, with exports dropping to less than $850,000 in July. Prior to the ban, U.S. beef exports to Colombia averaged $3 million per month.

Panel recommends USDA streamline meat plant inspections with new technology

The National Advisory Committee on Meat and Poultry Inspections (NACMPI) urged USDA to adopt new technologies to streamline inspections in meat and poultry plants. Recommendations include providing inspectors with government-issued phones and tablets to document findings, allowing video chat for communication, and using technology that converts voice or handwriting into digital text. These measures aim to reduce inspectors' workloads and speed up inspections. While some changes, such as remote inspections, may reduce delays and costs for companies, others, like video recording inside plants, could raise competitive concerns.

First US bird flu outbreak in nine weeks

Highly pathogenic avian influenza was confirmed at a turkey farm with 62,800 turkeys in Merced County, California, the first U.S. outbreak of bird flu in a commercial flock since July 19.

Neutral USDA cattle-on-feed report

USDA last Friday estimated there were 11.198 million head of cattle in large US feedlots (1,000-plus head) as of Sept. 1, up 71,000 head (0.6%) from last year. August placements declined 1.4%, while marketings fell 3.6% from year-ago levels. All of the categories were close to the average pre-report estimates.

USDA awards $35 million to boost US meat and poultry processing capacity across 12 states

USDA Secretary Tom Vilsack announced $35 million in grants to 15 independent meat processors in 12 states as part of the Meat and Poultry Processing Expansion Program (MPPEP). The funding aims to increase processing capacity, spur competition, and create rural jobs. This marks the final investment from the American Rescue Plan’s MPPEP, bringing total awards to over $325 million since 2022. The initiative seeks to strengthen the food supply chain and offer farmers more market opportunities.

USDA aims to finalize US livestock rules by year-end, eyes cattle price rule in 2025

USDA Secretary Tom Vilsack announced plans to finalize two livestock-related rules by the end of 2024, aligning with the Biden administration’s regulatory goals. The rules address fair livestock markets and poultry grower payment systems. Meanwhile, a pre-rule on cattle price discovery is expected to move forward in early 2025. However, these efforts may face uncertainty if Donald Trump wins the 2024 election, potentially altering or halting rulemakings initiated by the Biden administration.

EWG sues Tyson Foods for alleged false claims on environmental impact and sustainability

The Environmental Working Group (EWG) filed a lawsuit against Tyson Foods, Inc., accusing the company of making false and misleading claims about its environmental impact and sustainability efforts. The lawsuit, filed in the Superior Court of the District of Columbia, targets two main claims made by Tyson:

The company's commitment to achieve net-zero greenhouse gas emissions by 2050

Marketing of its beef products as "climate-smart"

The lawsuit argues that Tyson's claims are unsubstantiated and misleading to consumers who are increasingly interested in purchasing climate-friendly foods. EWG contends that Tyson produces significant volumes of climate-warming emissions at every stage of its industrial meat production process. The environmental group claims that Tyson has no concrete plans to achieve its stated goals and is not taking meaningful steps to do so.

The lawsuit alleges that despite Tyson's annual revenues exceeding $53 billion, the company spends less than $50 million (less than 0.1% of its revenue) on greenhouse gas reduction practices. EWG claims that Tyson spends about eight times more on advertising than on research.

Tyson produces about 20% of U.S. beef, chicken, and pork. The company's greenhouse gas emissions reportedly exceed those of entire countries like Austria or Greece. Beef production is said to be responsible for 85% of the company's emissions.

The lawsuit was filed under the District of Columbia Consumer Protection Procedures Act (CPPA). EWG is being represented by a coalition of environmental and animal rights organizations. The lawsuit seeks injunctive relief, aiming to stop Tyson from continuing to make these environmental claims and to hold the company accountable for alleged violations of the CPPA.

Upshot: This legal action is part of a growing trend of scrutiny over corporate environmental claims, often referred to as "greenwashing.”

Weekly USDA dairy report

CME GROUP CASH MARKETS (9/20) BUTTER: Grade AA closed at $2.9725. The weekly average for Grade AA is $3.0205 (-0.1305). CHEESE: Barrels closed at $2.5900 and 40# blocks at $2.2375. The weekly average for barrels is $2.5755 (+0.1895) and blocks $2.2670 (-0.0220). NONFAT DRY MILK: Grade A closed at $1.3800. The weekly average for Grade A is $1.3845 (-0.0075). DRY WHEY: Extra grade dry whey closed at $0.5875. The weekly average for dry whey is $0.5910 (-0.0020).

BUTTER HIGHLIGHTS: Butter demand in the East is steady. Butter demand is picking up in the Central region. For the West region, salted butter demand is steady, but unsalted butter demand varies from steady to lighter. Cream volumes are generally available throughout the country. However, cream volumes are comparatively tighter in the Northeast part of the nation. Butter production varies from strong to steady in the West. In the Central and East regions, butter producers convey production schedules are busier than expected. Butter manufacturers suggest production paces are comfortable for anticipated Q4 demands. Bulk butter overages range from minus 5 cents to 10 cents above market, across all regions.

CHEESE HIGHLIGHTS: Contacts share mixed cheese production throughout the U.S. Cheesemakers in the East note limited spot milk availability as Class I demand draws upon milk volumes available for cheese processing. Contacts note demand for several cheese varieties is steady to stronger. In the Central region, contacts note plant maintenance and downtime have freed up some milk supplies for processors. For the first time in several weeks, spot milk prices were reported below Class III, ranging from $0.75 below to $3.50 above Class III. Cheesemakers in the region say production efforts are geared toward upcoming holiday demands. Barrel inventories have grown enough to accommodate spot purchases. In the West, cheese manufacturers relay steady to stronger production, despite variable spot milk availability. Cheese inventories in the region are mixed, with barrel inventories noted to be especially tight. The CME closing price for barrels reached a record high of $2.5650 on Tuesday the 17th and inched even higher to $2.6225 on Wednesday the 18th.

FLUID MILK HIGHLIGHTS: Farm level milk production varies across the United States. Lighter production is being seen throughout the Central U.S. and the Southeast where farms are experiencing warmer temperatures that have affected cow comfort. Steady production levels are being seen in the Northeast and Mid-Atlantic states, where seasonally cooler temperatures have begun to move in. Volumes in the West are varied across the region. California is seeing weaker numbers. Farm level milk output is steady in Arizona. Numbers are stronger in New Mexico, the Pacific Northwest and the mountain states. The price range for spot milk has widened with loads of milk being reported at $0.75 under Class III up to $3.50 over Class. Spot milk loads remain scarce, but stakeholders convey some loads can be found to fill needs. Class I demand is near the seasonal peak all over the country and is affecting milk volumes that might have gone to Classes II, III and IV. Demand for milk in those Classes are steady to robust. Cream is generally more available in all regions due to Class I spinoff. Cream demand is steady to lighter in the West while it slightly stronger in the Central and East regions. Production of cream cheese is seeing an uptick in some regions. Demand for condensed skim is steady as availability continues to tighten. Cream multiples for all Classes are 1.23-1.45 in the East; 1.20-1.34 in the Midwest; and 1.10-1.29 in the West.

DRY PRODUCTS HIGHLIGHTS: Dry dairy commodities remain in a generally bullish pattern in the penultimate trading week of the quarter. In fact, prices for low/medium heat nonfat dry milk (NDM,) dry buttermilk, dry whey and whey protein concentrate (WPC) 34% were steady to higher throughout the country. NDM demand is brisk, but there are notes of customer pushback at increasing prices. Dry buttermilk trading activity picked up this week, as customers are showing more interest in recent weeks. Availability of dry whey is tight, as light seasonal milk supplies continue to get pulled from Class III to Class I plants. Lactose prices were steady. Availability of lactose varies from lower- to higher-mesh sizes, as the former is noted as somewhat available. Whey protein concentrate 34% interest is firming. Dry whole milk prices moved higher on continued reports of tight availability. Acid and rennet casein prices were steady on limited trading activity.

ORGANIC DAIRY HIGHLIGHTS: Federal Milk Market Order 1, in New England, reports utilization of types of organic milk by pool plants. During August 2024, organic whole milk utilization totaled 18.52 million pounds, up from 18.14 million pounds the previous year. The butterfat content, 3.28 percent, is unchanged from a year ago. The utilization of organic reduced fat milk, 15.55 million pounds, decreased from 15.61 million pounds a year ago. The butterfat content, 1.50 percent, is up from 1.40 percent the previous year.

NATIONAL RETAIL REPORT: Conventional dairy ads increased by 11 percent, and organic dairy ads decreased by 45 percent this week. Total conventional cheese ad numbers increased by 10 percent this week. Conventional 6-8 ounce packages of sliced, shredded and block cheese have weighted average advertised prices of $2.56, $2.60, and $2.55, respectively. Both the sliced and shredded style cheeses made appearances in ads more than twice as often compared to the block style for the 6-8 ounce package size. All three styles had price decreases for this package size. The shredded style had the biggest decrease, which was 10 cents.