Fao: Global meat prices 2021

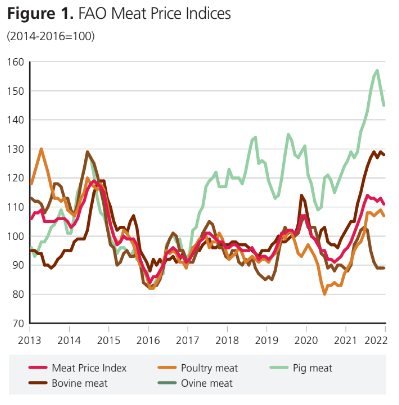

International meat prices rose amid tight global supplies from leading exporters.International meat prices, measured by the FAO Meat Price Index averaged 107.7 in 2021, up 12.2 points (12.7 percent) from 2020. In 2021, ovine, bovine, and poultry meat sub-indices registered sharp increases, while the pig meat sub-index remained largely unchanged.

Tight supplies from leading exporting countries underpinned the 2021 international meat price increases. These tight supply conditions emerged due to the challenging production environment faced by many countries. Bovine meat supplies were exceptionally tight, reflecting the short supply of cattle for slaughter in South America due to lower cattle inventories, and in Oceania, amidst high herd rebuilding demand.

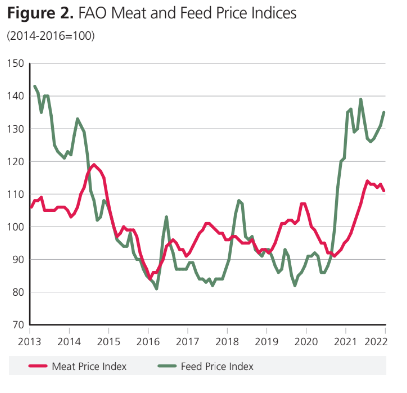

Meanwhile, the continued impacts of the African swine fever and increased production costs and market uncertainties across many key exporting regions, constrained production growth and pig meat deliveries. In addition, the poultry sector faced Highly Pathogenic Avian Influenza (HPAI) outbreaks in Asia and Europe, curtailing production and export growth. Similarly, ovine meat exports from Oceania, the world’s largest exporter, remained limited due to high flock rebuilding demand. Increased input costs, mainly feed and energy costs, logistical hurdles and freight costs, discouraged meat producers across many countries, reducing meat production growth.

On the demand side, China continued to be the largest meat importer, accounting for 26 percent of global meat imports in 2021, despite a decline in pig meat imports. Imports of other large meat importing countries, namely, Mexico, the United States of America (the United States), the Republic of Korea and Japan remained strong, driven mainly by increased economic activities and the revival of the hospitality industry with increasingly relaxed social-distancing requirements and successful COVID-19 vaccination campaigns.

World total meat production and trade

Global meat production expanded, but trade growth slowed down

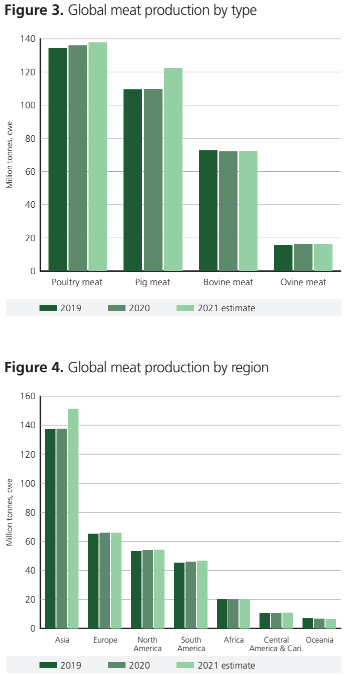

World total meat production reached 355.5 million tonnes (in carcass weight equivalent) in 2021, up 4.5 percent from 2020. Increased pig meat output underpinned the total meat production expansion, with poultry meat making the second-highest volume gain, followed by bovine and ovine meats.

Following the ASF virus outbreak in 2018, China’s pig herd registered a faster-than-anticipated recovery, lifting global pig meat output in 2021. In many countries, poultry meat output also increased, induced by elevated demand for low-cost alternatives.

Meanwhile, bovine meat output expanded, albeit slowly, underpinned by production expansions in Asia, North America and Central America and the Caribbean, offset by declines in South America and Oceania due to lower cattle supplies.

Ovine meat output expanded mainly in Asia. Regionally, Asia dominated the global meat output expansion, with some increases also registered in the Americas and Africa, while those in Europe remained stable but declined in Oceania.

China recorded the highest meat production expansion in 2021, followed by some gains in Brazil, India, Türkiye, Myanmar, Pakistan, Indonesia and Viet Nam, among others, but offset by declines in the Philippines, Argentina, Australia, and the United Kingdom of Great Britain and Northern Ireland (the United Kingdom).

In China, farm consolidation favouring large-scale farms, new feed management and breeding technologies have helped large-scale farmers to excel in productivity growth. By contrast, animal diseases, especially ASF, HPAI and foot and mouth disease, dented growth in meat production across many countries.

Increased feed, fertilizer, and energy costs squeezed producer margins, causing production growth to subside in some countries. On the demand side, global demand for meat products expanded, reflecting increased economic activities in parallel with increasingly relaxed social-distancing requirements, improvements to supply chains disrupted by the pandemic, growing incomes and rising populations.

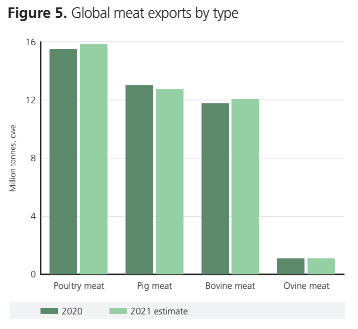

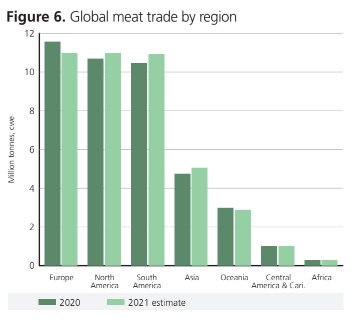

World total meat exports reached 42.1 million tonnes in 2021, up 0.9 percent from 2020, albeit slower than the average growth rate. The growth slowdown in 2021 reflects significant import curtailment in Asia and Europe, offset by increases in the Americas, Africa and Oceania.

Looking at country-specific performance, China registered a sharp decline in imports due to growing internal production and low domestic prices, along with some drops in the United Kingdom, the European Union, Iraq, and Canada.

Regarding exports, Brazil and the United States have increased their market shares in the global meat export market, with Brazil’s share rising from 19.2 to 19.9 percent and that of the United States from 20.3 to 20.7 percent. Uruguay, Türkiye and India, in particular, shipped more meat, partially offset by declines in the European Union, the United Kingdom, Australia and Argentina.

Regarding meat categories, poultry meat exports expanded the most, followed by bovine meat, while ovine meat exports remained largely stable and those of pig meat contracted.