NZ Beef Mid Season Update 2011-12

Beef exports are likely to increase in 2012, whilst excellent seasonal conditions will push cattle weights higher. Farmgate prices are not likely to change much, according to the Beef and Lamb NZ Mid Season Update.Livestock Numbers

Total beef cattle numbers at 30 June 2011 provisionally 3.88 million head decreased 1.7 per cent on the previous June. The greatest decrease was in breeding cows which decreased 3.2 per cent. The driver of this decrease was high schedule prices that encouraged culling of dry and poor performing breeding cows.

North Island beef cattle numbers decreased 2.3 per cent to 2.77 million head at June 30 2011. Continued demand from the dairy industry for breeding/finishing land within the Taranaki-Manawatu region with dairy grazers being substituted for beef cattle contributed to this decline. Overall, North Island beef cow numbers decreased 2.6 per cent for the year to 30 June 2011.

South Island beef cattle numbers estimated at 1.11 million head were almost static (-0.2%) on the previous June. Ideal climatic conditions resulted in an increase in finishing cattle retentions, particulary in Otago where total cattle numbers increased 7.4 percent. Within this South Island beef cow numbers to 30 June 2011 decreased 4.2 percent.

Dairy cattle at 30 June 2010, totalled provisionally 6.18 million head. This was an increase of 4.4 per cent or 260,000 head on the previous June period. As referred to earlier in this section one of the drivers of the sheep flock decline was the increase in dairy cattle numbers. This was largely driven by an estimated 120 new dairy farms starting in the spring of 2011 along with a recovery in dairy cow numbers from drought particularly on the North Island.

Beef And Veal Exports

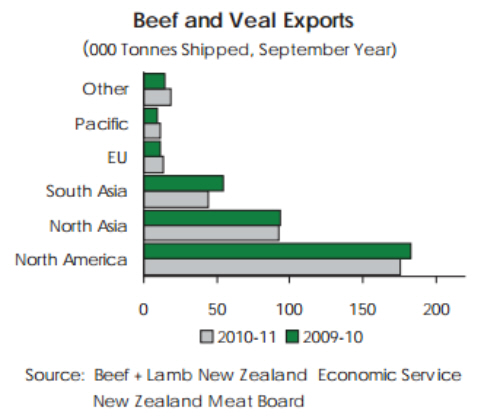

In the year ended 30 September 2011 New Zealand beef exports decreased 2.3 per cent to 356,100 tonnes shipped weight. However, beef exports receipts increased 14.8 per cent to $2.1 billion with the price per tonne increasing 15.8 per cent. North America accounted for 49.0 per cent of beef exports but 45.0 per cent of export receipts due to shipments dominated by processing beef.

Total exports to North America decreased 4.0 per cent from the previous year to 175,902 tonnes. Shipments to USA and Mexico decreased 7.0 and 18.0 per cent respectively while shipments to Canada increased 22.0 per cent.

North Asia, the next largest market region, took 26.0 per cent of New Zealand’s beef exports. The main markets in North Asia were South Korea (9.8%), Japan (8.5%) and Taiwan (5.5%) which accounted for 24.0 per cent of beef export receipts and tonnage shipped.

Exports to South Asia decreased 18.9 per cent to 43,900 tonnes shipped weight. The majority of the decrease was to Indonesia (-28.7%) reflecting Indonesian plans to curb beef imports and increase their domestic beef supply.

New Zealand beef exports to the European Union (EU) in the year to 30 September 2011 increased 24.5 per cent. Overall the EU took 3.9 per cent of beef exports but accounted for 8.4 per cent of total export receipts reflecting the high value mix of cuts that New Zealand ships to the EU.

For 2011-12, total FOB receipts for beef products (including co-products) under the USD 0.79 exchange rate scenario are estimated to increase 1.7 per cent to $2.59 billion on the previous year. Beef shipments are expected to increase (+4.5%) on the previous year while the price per tonne is estimated to decrease 2.4 per cent.

Co-products export value are expected to remain almost static (+0.2%) at $473 million even though the associated beef volume increases.

Final data for the year ended 30 September 2011 shows total beef receipts were $2.55 billion, up 13.3 per cent on the previous September year. This reflects a 14.8 per cent increase in beef price while volumes shipped decreased 2.3 per cent.

Beef Price – International Situation

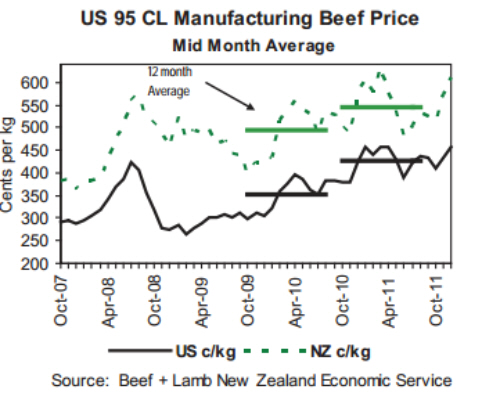

The graph above illustrates the effect of the weaker USD against the NZD on New Zealand beef returns in 2010-11. In 2010-11, the annual average in-market US beef price increased 20.6 per cent compared with the previous year while the same price in New Zealand increased a significantly lesser 10.5 per cent. This was driven by the weaker USD compared with the NZD. The NZD:USD exchange rate averaged 0.79 cents in 2010-11 compared with an average of 0.71 cents for the previous year. In 2011-12 season average in market prices and NZD:USD are expected to remain almost unchanged.

Overview

The global economy remains uncertain with increasing fears of recession in Europe. This is expected to soften consumer demand for high value food products.

United States

As expected the US herd continues to shrink. The January 2012 cattle inventory was down 2.0 per cent on the previous year to 90.8 million head, and the beef cow inventory was down 3.0 per cent. Liquidation has continued due to high feed costs and drought conditions in Texas and surrounding states which account for 40.0 per cent of the US beef cow herd.

In 2011 US beef exports achieved a milestone, with shipments surpassing the volumes that existed prior to the discovery of BSE in December 2003.

US beef exports grew 19 per cent in 2010 and provisional figures for 2011 show an increase of 25.0 per cent. Export accounted for 11.0 per cent of total beef production. Despite high prices for beef in US, these have not been enough to encourage expansion.

The latest USDA forecast is for a 14 per cent increase in beef imports in 2012.

Australia

ABARE reports the Australian cattle herd to increase by 5.0 per cent in 2011-12 to 30.2 million, supported by good weather conditions and pasture growth.

Beef cattle slaughter is forecast to decrease by 2.0 per cent to 7.9 million head, the lowest since 1995-96. Despite the fall in total slaughter, Australian beef and veal production is forecast to remain unchanged at 1.2 million of tonnes because of higher average carcass weights due to the good pasture availability.

Total Australian beef exports are forecast to remain unchanged at 941,000 tonnes although market diversification is increasing. Over the last decade exports to USA, Japan and Korea, the three main markets for Australian beef, accounted for 82.0 per cent of all beef exports. In 2011-12 these are estimated to fall to 68.0 per cent.

North Asia

The Japanese market is not expected to change in 2012 as the market continues to be “fragile” after the earthquake, tsunami and subsequent nuclear reactor breaches in addition to currency issues and a sluggish economy.

Japan is one of the leading export destinations for US beef and import data for the year to November 2011 showed US exports to Japan were up 29.0 per cent in volume and 38.0 per cent in value compared with the same period for 2010.

European Union

Beef output in the EU-17 region is expected to fall by almost 3.0 per cent in 2012 to just over 7.1 million tonnes. This fall is largely attributable to lower production in France, the UK and Ireland. French output is forecast to fall by 4.0 per cent to 1.51 million tonnes on the back of the drought that occurred earlier in 2011 which led to some liquidation of the herd. UK output is expected to fall by 6.0 per cent to 881,000 tonnes with most of this fall occurring in the first half of the year.

Beef Prices – Farm-Gate

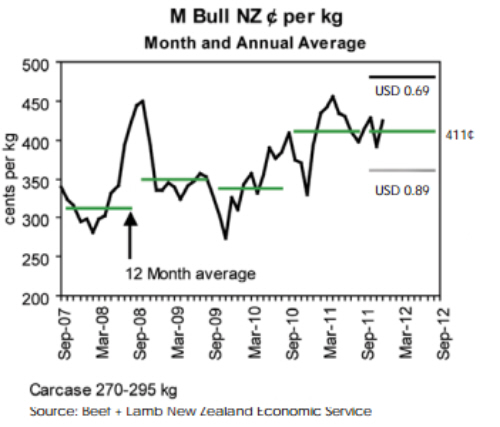

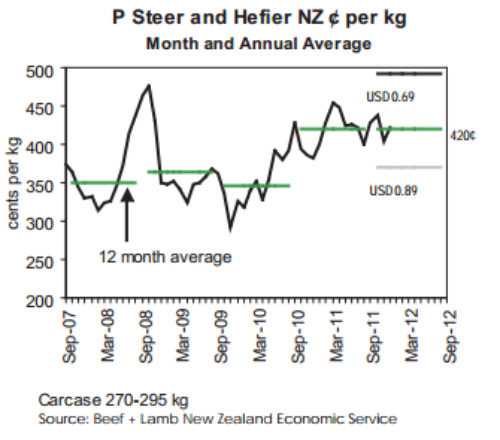

The monthly trend for the M Bull, P Steer and Heifer (270-295kg) schedule price to the end of September 2011 is shown in the two graphs above. Three exchange rate scenarios are provided in the 2011-12 outlook to cover possible exchange rate variability. The three scenarios use annual average exchange rates of USD 0.69, USD 0.79 and USD 0.89 and the associated cross rates against the GBP and EUR. At USD 0.79, the estimated average price for M Bull (270-295kg) is 411 cents per kilogram (+0.1%) and for P Steer/Heifer (270-295kg) 420 cents per kilogram (+0.1%).

Beef Production

Cattle Overall

In 2011-12 cattle slaughter is estimated to increase 1.7 per cent to 2.31 million head. The increase is driven primarily by an expected increase in cow slaughter (+2.2%) linked to the dairy herd expansion. The 2010-11 export cattle slaughter increased 1.2 per cent to 2.28 million. The increase was from cow and heifer slaughter underpinned by the expansion of the dairy herd.

Carcase Weight

Export cattle weights increase an estimated 2.8 per cent to 258.2kg for 2011-12. Slaughter weights increase across all classes of cattle due to exceptionally good seasonal conditions in most regions.

For 2010-11 export cattle weights decreased 2.7 per cent to 251.2kg. This was underpinned by steer and bulls being slaughtered at lighter weights, indicating leaner seasonal conditions and younger stock in the slaughter mix than in some years.

Cow

For 2011-12, the cow slaughter increases 2.6 per cent to 878,000 head, an increase of 22,000 head on last year. This is linked to the increase in dairy cow numbers, the majority of the increase taking place in the South Island.

For 2010-11 cow slaughter numbers increased 4.6 per cent to 856,000 head on the previous year. This was due to increased slaughter in both Islands particularly the South Island (+10.0%) due to the majority of the dairy herd expansion occurring in the South Island.

Bull

In 2011-12 the export bull slaughter is estimated to remain almost static (+0.5%) on the previous year at 436,000 head. This reflects little change in dairy bull beef calves retained in the previous two years. In 2010-11 the export bull slaughter decreased marginally (-0.5%) on the previous year to 434,000 head.

Heifer

For 2011-12, the New Zealand export heifer slaughter increases (+2.4%) to 419,000 head, up 10,000 on last year. The largest change occurs in the South Island (+6.5%) which follows the dairy cow herd increase in recent years. For 2010-11 the export heifer slaughter increased 2.4 per cent to 409,000 head. This was due to a 3.7 per cent increase in North Island heifer slaughter numbers, off-setting a 1.5 per cent decrease in South Island heifer slaughter.

Steer

The steer slaughter for 2011-12 increases slightly (+0.7%) to 581,000 head. This was due to an increase in finishing cattle held over particularly in the South Island following favourable pasture cover in 2010-11.

For 2010-11 steer slaughter numbers decreased 3.0 per cent to 577,000 head. The largest of these changes occurred in the South Island with a decrease in slaughter to 165,000 (-5.8%) head due to an increase in finishing stock retentions.