US Beef Export Value Again Tops $8 Billion

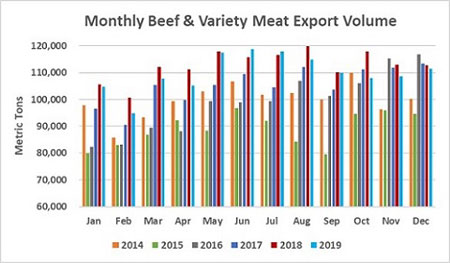

US - Exports of US beef were below the previous year’s record levels, according to data released by USDA and compiled by USMEF.

December beef exports totaled 111,315 mt, down 1 percent from a year ago, valued at $682 million (down 3 percent). 2019 exports totaled 1.32 million mt, 2.5 percent below the previous year’s record volume. After increasing by more than $1 billion in 2018, beef export value eased by 3 percent to $8.1 billion.

Beef export value per head of fed slaughter was $321.21 in December, down 9 percent from a year ago. The 2019 average was $309.75, down 4 percent. December exports accounted for 14.3 percent of total beef production and 11.6 percent for muscle cuts only, down from 15.5 percent and 12.6 percent, respectively, a year ago. 2019 exports accounted for 14.1 percent of total beef production and 11.4 percent for muscle cuts, down from the previous year’s record-high percentages (14.6 percent and 12.1 percent, respectively).

New beef export records for Korea and Taiwan; strong year for beef variety meat

The decline in US beef exports from the record levels of 2018 was partially attributable to lower shipments to Japan, which were down 6 percent in both volume (311,146 mt) and value ($1.95 billion). Similar to pork, Japan’s tariff rates for US beef were lowered on 1 January to match those of major competitors, with rate for US beef muscle cuts dropping from 38.5 to 26.6 percent. Another tariff rate cut will come 1 April, when the Japanese fiscal year begins. December exports to Japan were slightly above year-ago levels in both volume (24,056 mt) and value ($144.6 million).

"It was gratifying to see beef exports to Japan perform so well in December, given that the first tariff rate cut was pending and set to take effect 1 January," USMEF President and CEO Dan Halstrom observed. "Buyers in Japan have been waiting a very long time for tariff relief and have already responded enthusiastically. We look forward to solid growth in 2020 and beyond."

South Korea made a strong push to become the leading value market for US beef in 2019, finishing a close second to Japan at a record $1.84 billion (up 5 percent from a year ago). Korea was also the second largest volume market for US beef at 255,758 mt (up 7 percent, also a new record). The United States captured a larger share of Korea’s chilled beef imports in 2019 at 62 percent, up from 58 percent the previous year. US beef accounted for 51.5 percent of Korea’s total beef and beef variety meat imports and more than one-third of Korea’s total beef consumption.

"US beef is achieving remarkable success in Korea’s traditional retail and foodservice sectors and is well-positioned to capitalize on growth in e-commerce, the institutional sector and other emerging sales channels," Mr Halstrom said. "As US beef moves steadily toward duty-free status in Korea, it becomes accessible and affordable for a wider range of customers whose appetite for US beef continues to grow. We are seeing many new menu concepts in this dynamic market and continued excitement about US beef."

Beef exports to Taiwan were record-large for the fourth consecutive year in 2019, climbing 6 percent from a year ago in volume (63,538 mt) and 3 percent in value ($567.1 million). This growth is also driven by success at foodservice and retail as Taiwan continues to embrace alternative cuts and US beef is underpinning overall consumption growth. The United States dominates Taiwan’s chilled beef market, capturing approximately 75 percent of its chilled imports – the highest share of any Asian destination.

Other 2019 highlights for US beef exports include:

- In Mexico, the third largest market for US beef behind Japan and Korea, export value increased 5 percent from a year ago to $1.1 billion despite a 1 percent decline in volume (236,707 mt). This was largely due to strong demand for beef variety meat, especially tripe. Variety meat exports to Mexico increased 4 percent year-over-year in volume (100,645 mt) and surged 21 percent in value to $276.9 million. This included $111.7 million in tripe exports, up 30 percent from a year ago.

- The largest decline in US beef exports in 2019 was to China/Hong Kong (103,220 mt, down 21 percent, with value down 19 percent to $830 million). Retaliatory duties and other restrictions limited US exports to China, but the Phase One trade agreement includes significant breakthroughs in market access that should allow a much larger share of US beef production to be eligible for China. Although China’s beef demand has recently slowed, its overall beef imports reached a staggering $8.4 billion in 2019, a 70 percent increase over the 2018 record.

- Led by strong demand in Indonesia, beef exports to the ASEAN region increased 23 percent from a year ago in volume (60,790 mt) and were 8 percent higher in value ($295.5 million). Exports to Indonesia reached record heights, climbing 67 percent from a year ago in volume (23,591 mt) and 37 percent higher in value ($85.1 million). This included a near doubling of variety meat volume (to 12,688 mt) along with substantial growth in muscle cuts.

- Despite a slowdown in December, exports to the Dominican Republic easily surpassed the previous year’s record in both volume (8,034 mt, up 18 percent) and value ($65.8 million, up 13 percent).

- Fueled by outstanding demand in Panama, exports to Central America increased 3 percent from a year ago in volume (15,156 mt) and 7 percent in value ($86 million). Exports to Panama surged 33 percent to 2,278 mt valued at $14.7 million (up 30 percent).

- Mexico was one of several markets driving strong demand for US beef variety meat in 2019. Global variety meat exports increased 4 percent from a year ago in volume (322,529 mt) and 9 percent in value ($972.9 million). Exports to Japan, which largely consist of tongues and skirts, totaled 62,948 mt, up 19 percent from a year ago, valued at $387 million (up 13 percent). Prospects for further growth are very strong in Japan, with beef from cattle of all ages now eligible and lower tariff rates under the US-Japan trade agreement (Japan’s tariff rate for US tongues will phase to zero by 2028 and for other variety meat by 2030). Egypt, the largest destination for US beef livers, saw a 3 percent increase in variety meat volume (63,449 mt) while export value climbed 15 percent to $73.7 million. Beef variety meat exports also posted substantial year-over-year gains in Indonesia, the Dominican Republic, Chile, Angola, Gabon, Trinidad and Tobago, Mozambique and Nicaragua.

TheCattleSite News Desk