Analyst: Fastest US Cattle Expansion Since 1970s

ANALYSIS - Steve Meyer, VP at Express Markets Inc Analytics, shared his expectations for the beef and poultry markets at the 2016 World Pork Expo in Des Moines, Iowa, USA."The beef business is certainly in an expansion mode. They've had extreme profits at the cow-calf level for the last couple of years with big incentives," said Mr Meyer.

"The herd has grown back above 30 million on the beef count numbers. Matter of fact, we've had the fastest expansion of cattle inventories in the US that we've seen since the 1970s, over the last two years."

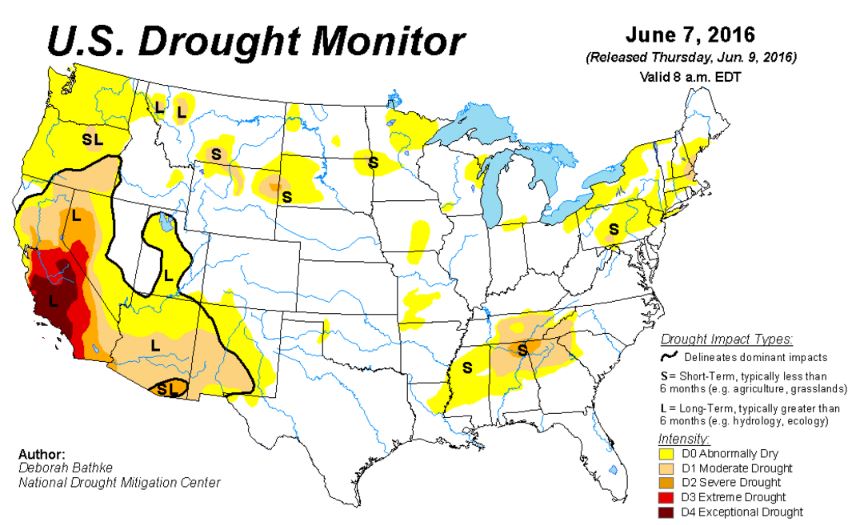

Profitability for cow-calf operations has been exceptionally high, and there are limited acres affected by drought conditions.

Beef production is expected to be up about 4 per cent in 2016 and again in 2017. The cow-calf crop should also be up 3 per cent this year and is expected to see long term growth, bouncing back from the cuts that the industry made in 2011 and 2012 due to drought areas.

"That has impacted cattle prices and, to a lesser degree, cut out values, but we still haven't seen much impact at the retail level yet. So we still have a pretty nice advantage from a pricing standpoint at the retail level," noted Mr Meyer.

"We think that's going to go away by sometime in mid-2017 and this beef price to pork price relationship, which normally was about 140 per cent - beef average retail 140 per cent of the average retail price of pork. That's been up to 160 per cent or so the last two years. We think it's going to come back to more normal [levels] sometime in 2017, but until then [pork] will have some advantage."

Poultry Market

The US poultry industry is expected to see growth, but slower growth. The broiler breeder flock is expected to grow less than 1 per cent over the next couple of years. The rapid increase in weights is also expected to slow.

The US poultry industry is expected to see growth, but slower growth. The broiler breeder flock is expected to grow less than 1 per cent over the next couple of years. The rapid increase in weights is also expected to slow.

"The [poultry industry] has run into some product quality problems, called woody breast. It's a muscle tissue atrophy situation in these fast growing, big birds, and so we're going to slow them down and not take them up much more," he said. "We have weights up less than 1 per cent in the next two years."

Mr Meyer expects to see a rebound in US poultry exports. Last year, US exports were down 14 per cent due to avian influenza, but the industry won't reach 2013 levels within the next two years, Meyer said.

"Per capita offerings on chicken are basically flat the next two years in the US," he said. "That's positive [for the pork industry] of course because their prices aren't going to go down and put pressure on [pork]."