Global Beef Trade: Effects of Measures on U.S. Beef Exports

How have market access barriers affected U.S. beef producers and exporters? This report published by the United States International Trade Commisssionan provides an overview of U.S. and global beef markets, with information on animal health, food safety measures and the economic effects of foreign measures on U.S. beef exports.

Executive Summary

The United States is the world’s largest beef producer, and until BSE-related restrictions were imposed in 2003, the world’s largest beef exporter. The cattle and calf industry continues to be an integral sector of the U.S. economy, accounting for more than 20 percent of the total value of U.S. agricultural production in 2006.1 In 2007, the retail value of U.S. beef and edible offal production was $74 billion2 while 967,000 U.S. operations were involved in cattle and calf production.3 The industry is also a major employer; the meat packing industry alone provided 147,000 jobs in 2005.4

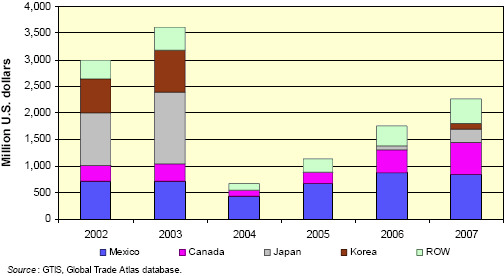

The discovery of bovine spongiform encephalopathy (BSE), in a dairy cow of Canadian origin, in the U.S. cattle herd in late 2003 led many countries to restrict imports of U.S. beef, resulting in significant losses in exports and industry revenues during 2004–07 (figure ES.1). Beginning in 2004, several countries resumed trade, confident that the regulations and oversight implemented by the United States were sufficient to ensure the health and safety of U.S. beef. Yet certain markets, most notably Japan and Korea, continued their restrictions, such that the value of U.S. beef exports to the world in 2007 was only about two-thirds the 2003 level. U.S. beef industry representatives view continued market access barriers as unjustified. Continued Korean government restrictions on U.S. beef imports have become a major impediment to consideration by the U.S. Congress of legislation to approve and implement the U.S.-Korea Free Trade Agreement.

This report responds to a request by the Senate Committee on Finance (Committee) for information and analysis on how market access barriers have affected U.S. beef producers and exporters. Specifically, the Committee requested that the report provide the following information and analysis: (1) an overview of U.S. and global beef markets; (2) information on animal health and food safety measures facing U.S. and other major beef exporters in major destination markets; (3) information on other barriers to U.S. beef exports in major destination markets; and (4) analysis of the economic effects of foreign animal health, food safety, and other measures on U.S. beef exports. The major findings and some key observations from this study are summarized below.

Major Findings and Observations

BSE-related restrictions on exports have resulted in substantial losses to the U.S. beef industry.

During 2004–07, BSE-related restrictions were a major barrier to U.S. beef exports; these restrictions cost the U.S. beef industry $1.5–2.7 billion in lost revenue annually. A loss in annual export sales ranging from $3.1 billion in 2004 to $2.5 billion in 2007 was offset in part by additional sales in the domestic market. Annual losses were greatest in 2004 and have since declined, as some countries have eased restrictions and U.S. exporters have developed alternative markets (albeit at lower prices).

Absent BSE-related restrictions, U.S. beef exports still face substantial impediments in the form of tariffs and tariff-rate quotas.

Even if all BSE-related restrictions were removed, U.S. beef exports would continue to face significant tariff and tariff-rate quota (TRQ) restrictions. Annual U.S. beef exports would be expected to increase by about $1.4–1.7 billion if global tariffs and TRQs on imports of U.S. beef were removed. During 2004–07, potential gains in export sales from removing tariffs and TRQs were estimated to be $6.3 billion over the four-year period, substantially less than the losses in export sales associated with BSE-related restrictions (table ES.1).

| TABLE ES.1 Beef: Losses in U.S. exports resulting from BSE-related restrictions and potential gains from removal of tariffs and TRQs, by market, 2004-07 (billion dollars) | |||

| Market | BSE restrictions | Tariffs and TRQs | Total |

|---|---|---|---|

| Japan | 5.7 | 4.1 | 9.8 |

| Korea | 3.7 | 1.3 | 5.1 |

| ROW | 1.5 | 0.9 | 2.4 |

| Total | 11.0 | 6.3 | 17.3 |

| Source: Commission estimates based on a simulation framework discussed in appendix G. Notes: Due to rounding, numbers may not add to total. ROW denotes rest of the world. |

|||

By far the greatest losses to the U.S. beef industry result from trade restrictions imposed by Japan and Korea.

Restrictions imposed by Japan and Korea on imports of U.S. beef have resulted in significant losses in export sales to the industry. During 2004–07, these two countries accounted for about 86 percent of the lost export sales caused by BSErelated restrictions and of potential export gains if tariffs and TRQs were removed.

Other measures impede U.S. beef exports in several key markets.

Although tariffs, TRQs, and sanitary and phytosanitary (SPS) regulations specific to BSE have presented the greatest obstacles, U.S. beef exports face additional restrictions in major markets (table ES.2). The EU continues to ban U.S. beef that has been treated with hormones (a ban that has been in place since 1989), whereas in other markets, restrictions include nontransparent sanitary and food safety regulations and cumbersome documentation and licensing procedures.

| TABLE ES.2 Beef: Other barriers to U.S. exports by selected markets | |

| Market | Type of barrier |

|---|---|

| Japan | Cumbersome document inspection, domestic industry support |

| Korea | Higher inspection rate, cumbersome document inspection, domestic industry support |

| EU | Hormone ban, small quota, domestic industry support |

| Russia | Uneven application of customs regulations and minimum import unit valuations, import licensing procedures |

| China | Nontransparent sanitary regulations, cumbersome documentation procedures |

| Source: Compiled by Commission staff. | |

Although the World Organization for Animal Health provides guidelines and standards regarding the safety of beef trade, it has no power to require that countries conform to its standards.

As of May 2007, the United States has been recognized by the World Organization for Animal Health (OIE) as a controlled risk country with regard to BSE. However, certain countries, including Japan and Korea, both members of the OIE, impose restrictions on U.S. beef that are more stringent than the OIE guidelines for a controlled risk country. The OIE has no power to require that countries conform to its guidelines and standards.

There is little consistency in the BSE-related restrictions imposed by major beef importing countries.

Countries apply different food safety standards for imported beef (table ES.3). Even slight differences in requirements impose significant costs on the U.S. beef industry. Such differences impair the ability of U.S. producers to sell specific products in the markets where they are most highly valued, decrease the range of products eligible for export to any particular market, and increase operating costs.

| TABLE ES.3 Beef: OIE standard and BSE-related restrictions on imports from the United States in selected markets | |||

| Market | Age restrictions | Specified risk material (SRM) definition | Commodity restriction |

|---|---|---|---|

| OIE standard | None | Brains, eyes, spinal cord, skull, and vertebral column of cattle over 30 months, plus tonsils and distal ileum of all cattle | No mechanically separated meat from the skull and vertebral column of cattle over 30 months of age |

| Japan | 20 months or younger | Head, tonsils, spinal cord and dura matter, distal ileum, vertebral column and dorsal root ganglia | No head meat, processed beef, ground beef, finely textured beef, or mechanically separated meat |

| Korea | Under 30 months | Brain, eyes, skull, tonsils, spinal cord, vertebral column, and distal ileum | No mechanically recovered meat or mechanically separated meat |

| EU | Prime and Choice beef from cattle under 30 months eligible for highquality beef quota | Brains, eyes, spinal cord, and skull, of cattle over 12 months; vertebral column and ganglia of cattle over 30 months; tonsils and intestines of all cattle | Beef for human consumption must comply with nonhorrmone treated cattle (NHTC) program, no antimicrobial treatment |

| China | Not applicable | U.S. beef ineligible for import | U.S. beef ineligible for import |

| Russia | Under 30 months | Brains, eyes, spinal cord, skull, and vertebral column of all cattle | Ground beef in bulk or patties ineligible for import |

| Canada | None | Same as OIE | Same as OIE |

| Mexico | Under 30 months | Brains, eyes, spinal cord, skull, tonsils, and small intestine | No ground meat, feet, sweetbreads, weasand meat, or head meat |

| Source: USDA, FSIS Index of Export Requirements for Meat and Poultry Products, (accessed August 18, 2008). | |||

The imposition of restrictions on imported beef in response to food safety concerns can occur quickly; lifting these restrictions takes time.

Typically, governments immediately close their borders when faced with concerns over the safety of food imports. However, once a market is closed, reopening can take months or even years. The U.S. BSE incident provides an example of this imbalance between imposing and relaxing trade restrictions. Once the existence of BSE was confirmed in the United States, countries banned U.S. beef within days. More than four years after these restrictions were imposed, many of them continue, generally in a modified form, preventing less than full market access.

Country-Specific Findings

Japan

- Model simulation results indicate that losses of U.S. beef exports to Japan due to BSE measures totaled $5.7 billion during 2004–07, primarily in fresh, chilled, or frozen boneless beef and frozen beef tongue. The removal of tariffs on U.S. beef imports over the same period would have increased U.S. exports to Japan by $4.1 billion. Thus, Japan is a highly protected market based on tariffs alone, but BSE restrictions on U.S. beef exports have a trade impact roughly 40 percent greater than the existing tariff protection.

- From December 2003 until December 2005, and then from January to June 2006, the government of Japan effectively banned imports of U.S. beef. When imports of U.S. beef resumed in July 2006, they were subject to 100 percent box inspection until July 2007. Current Japanese SPS measures permit imports of beef from cattle up to 20 months of age.

- Other trade barriers to U.S. beef exports to Japan include high tariffs (38.5 percent on the majority of imports), significant government support for the domestic beef industry, and administrative restrictions, including strict documentation audits of shipper manifests.

Korea

- Model simulation results indicate that losses of U.S. beef exports to Korea due to BSE measures totaled $3.7 billion during 2004–07, primarily in fresh, chilled, or frozen boneless beef; frozen bone-in beef; and frozen edible offal (other than tongues and livers). Removal of Korean tariffs on beef imports from the United States over the same period would have increased U.S. exports to Korea by $1.3 billion. Thus, Korea is a highly protected market based on tariffs alone. BSE restrictions on U.S. beef exports, however, have an adverse trade impact nearly 200 percent greater than the existing tariff protection.

- From December 2003 until September 2006, the government of Korea effectively banned imports of U.S. beef. When Korea began importing U.S. beef again, only boneless beef cuts from cattle no more than 30 months of age (UTM) were eligible for import. Restrictions on bone-in cuts eliminated a significant portion of U.S. beef trade with Korea that existed in 2003. Under an agreement between Korea and the United States, signed in April 2008, a new set of quarantine inspection procedures was put in place for imports of U.S. beef, but a transitional measure continued to prohibit beef from cattle over 30 months of age (OTM).

- Other trade barriers to U.S. beef exports to Korea include high tariffs (18–72 percent); significant government support for the domestic beef industry; administrative restrictions at customs, including unusual labeling requirements for U.S. beef and strict documentation audits of USDA health certificates; and country-of-origin labeling requirements for consumers at all Korean restaurants.

EU

-

Beef producers in the United States have largely been unable to benefit from export opportunities to the EU because of nontariff barriers to imports of U.S. beef. The EU is forecast to increase its total beef imports significantly over the next five years.

-

Because the EU has expanded from 12 member countries when the hormone ban was implemented to 27 member countries in 2007, the negative effects of the hormone ban have expanded. New member states that had served as alternate export markets in 2004, when BSE-related restrictions were imposed in several countries, have reduced their imports of U.S. beef since joining the EU.

-

The small volume of the current EU high-quality (Hilton) beef quota and the costs of the non-hormone treated cattle (NHTC) program have limited the ability of U.S. producers to supply the EU market.

China

-

Model simulation results indicate that losses of U.S. exports to China and Hong Kong due to BSE-related measures totaled $510 million during 2004–07. Export losses were greatest for frozen boneless beef, frozen offal, and fresh and chilled boneless beef. The removal of tariffs on imports of U.S. beef over the same period would have increased U.S. exports to China by $19 million.

-

The U.S. government has pressed China to follow OIE guidelines and place no limit on the slaughter age of cattle from which beef imports are produced. Hong Kong resumed boneless beef imports from UTM cattle from the United States in December 2005. Negotiations to expand Hong Kong’s acceptance of U.S. beef, consistent with full OIE standards, continue.

-

Other trade barriers to U.S. beef exports to China include moderately high tariffs (12–25 percent) and a 13 percent value added tax on imports. China maintains a number of measures that could constrain U.S. exports when the market reopens, such as restrictions on beef produced with hormones, nontransparent sanitary requirements, and cumbersome import documentation procedures. Hong Kong’s tariffs on all beef and offal products are zero. Hong Kong maintains a zero tolerance for bone fragments, which has led to the delisting of many U.S. plants, and also maintains onerous certification requirements for U.S. beef processing plants.

Russia

-

Model simulation results indicate that losses of U.S. beef exports to Russia due to BSE measures totaled $253 million during 2004–07, primarily in frozen liver and other edible offal. Removal of tariffs on U.S. beef over the same period would have increased U.S. exports to Russia by $54 million.

-

The government of Russia banned imports of U.S. beef in December 2003. For nearly 4 years following the ban, no U.S. beef processing facilities were approved for exporting beef to Russia. Russia’s animal health, sanitary, and food safety regulations are gradually and unevenly coming in line with international standards as Russia endeavors to accede to the World Trade Organization (WTO). Currently, Russia limits imports to beef products from cattle UTM, and Russian regulations define vertebral columns in cattle UTM as SRMs.

-

Other trade barriers to U.S. beef exports to Russia include moderately high tariffs (typically 15 percent but not less than €0.15 per kg for beef products shipped by U.S. exporters), limited government support for the domestic beef industry, and technical barriers that cause significant disruption in Russia’s beef imports. These barriers include the uneven application of Russian customs regulations in different ports of entry, the government’s practice of providing customs agents with unpublished recommendations on minimum import unit valuations which artificially boost ad valorem import tariffs, and Russia’s complex import licensing program, all of which add to importers’ costs and can create shipping delays.

Canada

-

Model simulation results indicate that losses of U.S. beef exports to Canada due to BSE measures were $346 million during 2004–05, primarily in fresh and chilled boneless beef. In 2006 and 2007, BSE-related restrictions in other export markets led to an increase in U.S. beef exports to Canada. Model simulation results indicate overall lost U.S. beef exports to Canada due to BSE-related restrictions totaled $242 million during 2004-07. The discovery of BSE in the Canadian herd and subsequent U.S. BSE-related import restrictions on Canadian cattle and beef indirectly affected Canadian demand for beef imports.

-

Canada continued to permit imports of U.S. fed cattle for immediate slaughter and boneless beef from cattle UTM following the discovery of BSE in the United States. In March 2005, Canada permitted imports of feeder cattle UTM and in June 2006 permitted imports of live cattle born after 1999 and all beef and beef products.

-

All cattle and beef products from the United States enter duty free under the North American Free Trade Agreement (NAFTA). There are no other major trade barriers to U.S. cattle and beef exports.

Mexico

-

Model simulation results indicate that losses of U.S. beef exports to Mexico due to BSE measures were $382 million during 2004–05. Export losses were primarily in fresh and chilled boneless beef. BSE-related restrictions in other export markets led to an increase in U.S. beef exports to Mexico in 2006 and 2007. Model simulation results indicate overall losses in U.S. exports to Mexico as a result of BSE-related restrictions totaled $390 million for 2004-07.

-

Mexico immediately banned imports of all U.S. cattle and beef products in December 2003. However, the market was quickly reopened to imports of boneless beef from cattle UTM in March 2004 and later to other beef products from cattle UTM. To date, Mexico continues to prohibit the import of U.S. beef cattle and beef products from cattle OTM.

-

Although all cattle and beef products from the United States enter duty free under NAFTA, Mexico maintains antidumping duties on certain bone-in and boneless beef cuts. Duties range from $0.07–0.80 per kg and were first established in August 1999. There are no other major trade barriers in Mexico to U.S. cattle and beef exports.

Footnotes

1 USDA, ERS, “State Facts,” (accessed September 2, 2008).

2 USDA, ERS, “U.S. Beef and Cattle Industry.”

3 USDA, NASS, Farms, Land in Farms, and Livestock Operations, 2004 Summary, January 2005, 14; USDA, NASS, Farms, Land in Farms, and Livestock Operations, 2007 Summary, February 2008, 14.

4 U.S. Department of Labor, Bureau of Labor Statistics, Quarterly Census of Employment and Wages, NAICS 311611. Meat packing includes both beef and pork products.

Further Reading

| - | You can view the full report by clicking here. |

October 2008